Link PAN with Aadhaar: The Central Board of Direct Taxes (CBDT) issued an order extending the date of PAN-Aadhaar linkage for certain persons to December 31, 2025. This extension concerns only those allotted the PAN based on the Aadhaar enrollment ID before October 1, 2024.

For all other PAN holders, the last date for linking PAN with Aadhaar without penalty was June 30, 2023. However, even otherwise, one can do it with a penalty.

Who Needs to Link PAN with Aadhaar before December 2025?

As per the latest CBDT notification of April 3rd, any individual who obtained his PAN using an Aadhaar enrollment ID (applied before October 1, 2024) should submit his Aadhaar number to the Income Tax Department by December 31, 2025; in case of failure to do so, the penalties or restrictions could applied on the usage of their PAN.

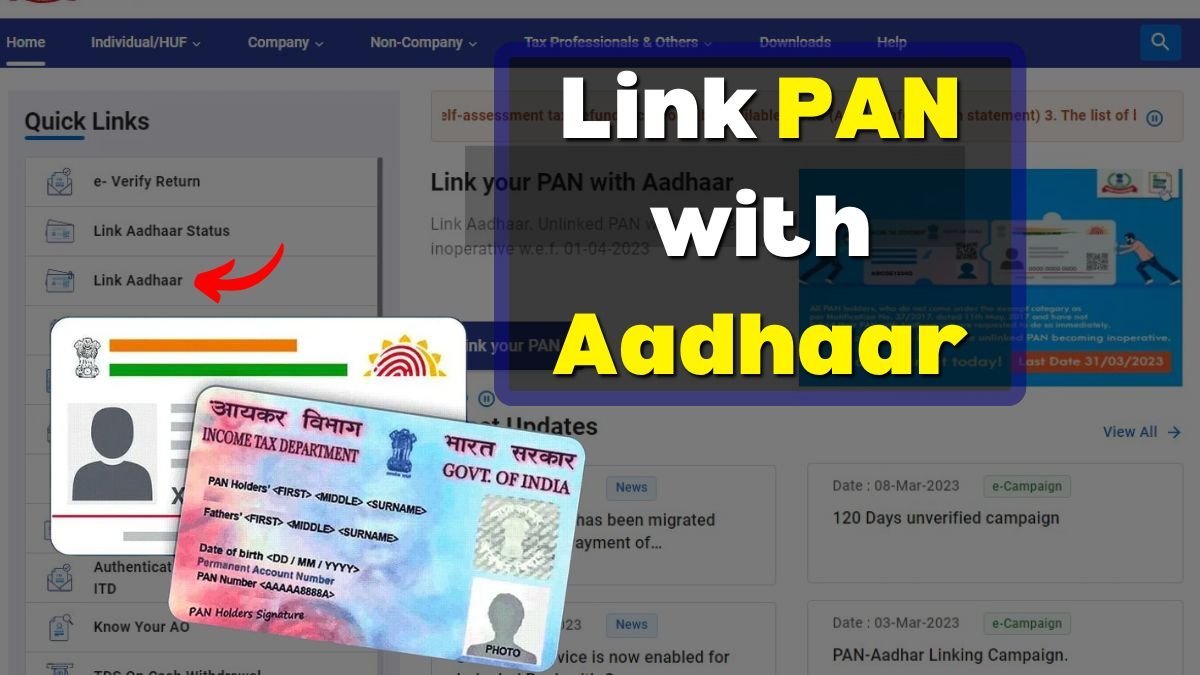

How to Link PAN with Aadhaar?

The CBDT has not specified a new procedure so that taxpayers can follow the existing methods:

Link PAN with Aadhaar Online Method:

- Visit the Income Tax e-Filing Portal (https://www.incometax.gov.in).

- Log in using your PAN and other details.

- Navigate to the “Link Aadhaar” section.

- Enter your Aadhaar number and submit.

- Verify details and complete the process.

Link PAN with Aadhaar Offline Method:

- Visit a PAN service center (NSDL or UTIITSL).

- Fill out Form Annexure-I.

- Submit copies of your PAN card and Aadhaar card.

- The authorities will process your request.

PAN Aadhaar Link Status Check

Step-by-Step Process to PAN-Aadhaar Link Status Check via SMS

- Open the SMS app on your mobile phone (the number registered with your Aadhaar and PAN).

- Type the following message in this exact format: UIDPAN <12-digit Aadhaar number> <10-digit PAN number> (Example: UIDPAN 123456789012 ABCDE1234F)

- Send this SMS to either 567678 or 56161.

- You will receive a reply confirming whether your PAN and Aadhaar are linked.

Important: Ensure Your Details Match!

Before linking, make sure the name, date of birth, and gender on your PAN and Aadhaar are identical. If there’s a mismatch, your request may be rejected.

How to Correct Mismatches?

- Update PAN details by filing a correction request with the Income Tax Department.

- Update Aadhaar details by visiting the UIDAI website or an Aadhaar enrollment center.